As a college student, the ultimate struggle that most of us face is budgeting. When to spend money, when not to spend money and how to save money are all common questions asked by students. Personally, I’m terrible at handling my money. But the one perk of being bad with money is that I’ve had to learn some tips and tricks in order to save more and spend less. I’m here to share some of those with you.

Keep a monthly budget

I’ve learned that it’s a lot easier to keep track of your money if you write down exactly what you’re spending it on. At the beginning of each month, create a note or find an online budgeting template and write how much money you have ready to spend. Then, write out all of your planned expenses such as shopping, food and necessities, entertainment, school supplies or anything else you might need. Every time you make a purchase, write that down too. Then, at the end of the month you can see how much money you spend in order to help gauge further spending habits.

If you want to buy something— wait

One of my worst habits is impulsively buying something or spending my money on something that seems worth it in the moment, but then I end up with buyer’s regret and a hole in my bank account. My best advice; if there’s something that you really want, but it seems like a purchase that could set you back a little bit, just wait. Give it a couple days or a week, however long it takes you to be fully confident in your decision. This has helped me realize that not everything we want we actually need right away. Save up for it and buy it later!

Keep your spare change— never doubt the piggy bank!

Spare change and loose bills are something I always lose track of because I don’t think they’re as important as my bank account. But, that’s just not true. Keep a jar of change and bills you find laying around and soon enough you’ll have some substantial savings! Many banks will take rolls of your coins and exchange them for cash, especially due to the coin shortage from COVID-19. You can also deposit cash into your bank account, so that cash-isn’t-real feeling goes away.

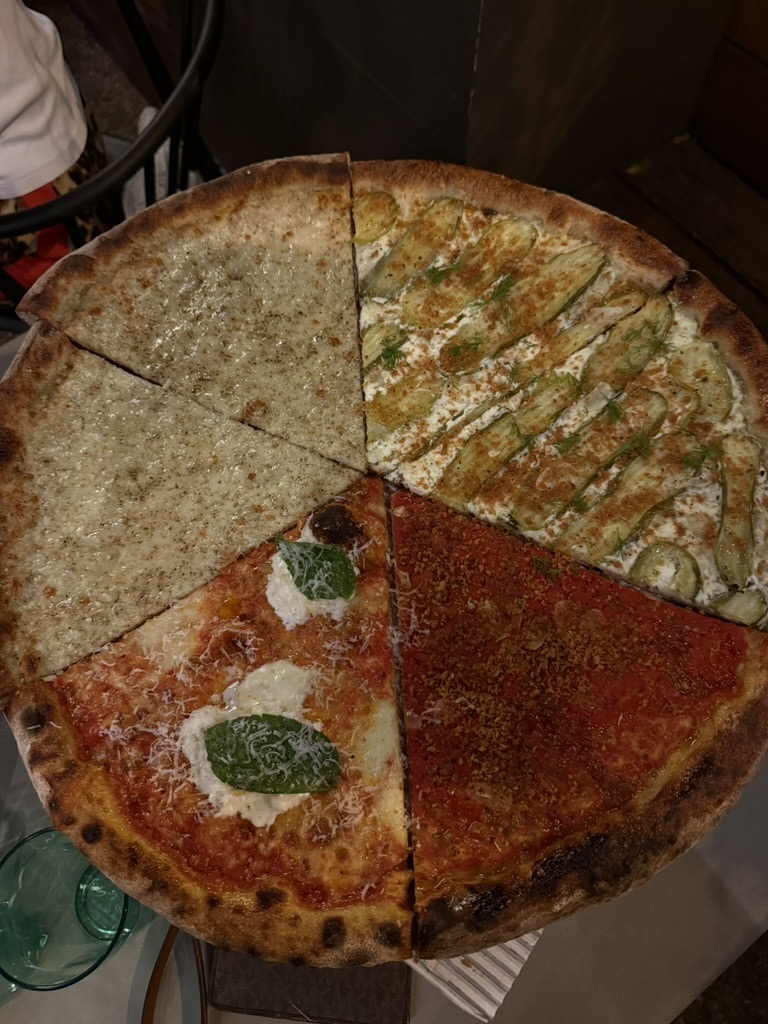

Limit going out

This one is probably the most difficult for me. Sometimes I get so caught up in my day that I let myself buy food or a fancy coffee when I always have something available for free. To combat this, I’ve set myself an allotted amount of days I can buy food for myself. Usually, I let myself buy coffee twice a week and eat out once during the week and once or twice on weekends. This has helped me so much to hold myself accountable and keep track of my spending. See what works for you, and do your best to stick to it.

For my 21+ people, if you go out, don’t bring your card

Lastly, an additional tip for people who like to go out on the weekends. Don’t bring your card to a bar, bring an amount of cash that you’re okay with spending on drinks or food. This can help those moments where you think, “oh it’s just one more it’s okay,” and you will save money without even realizing. You just have to remember to not promise to Venmo friends if they buy you something once you run out of cash- guilty as charged.

Remember, saving money is difficult, especially for students who aren’t used to living on their own and providing for themselves. Don’t get yourself down if it takes a little bit to get into a pattern of saving. Take it easy on yourself and do what you can, when you can. Don’t forget— a little goes a long way.

Featured image by Ren Breach